maryland earned income tax credit 2020

The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. Allowing certain taxpayers with federal adjusted gross income for.

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

2020 may be eligible for tax credits based on the.

. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. Businesses and Self Employed. 2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit.

For wages and other income earned in. Maryland United Way Helpline dial 211 or 1- 800-492-0618 and the TTY line is 410-685-2159. CASH Campaign of Maryland 410-234-8008 Baltimore Metro.

2020 may be eligible for tax credits based on the. If the credit is more than the tax liability the unused credit. Altering the calculation of the Maryland earned income credit to allow certain residents to claim the credit.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. Apply to tax years 2020 through 2022. Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of.

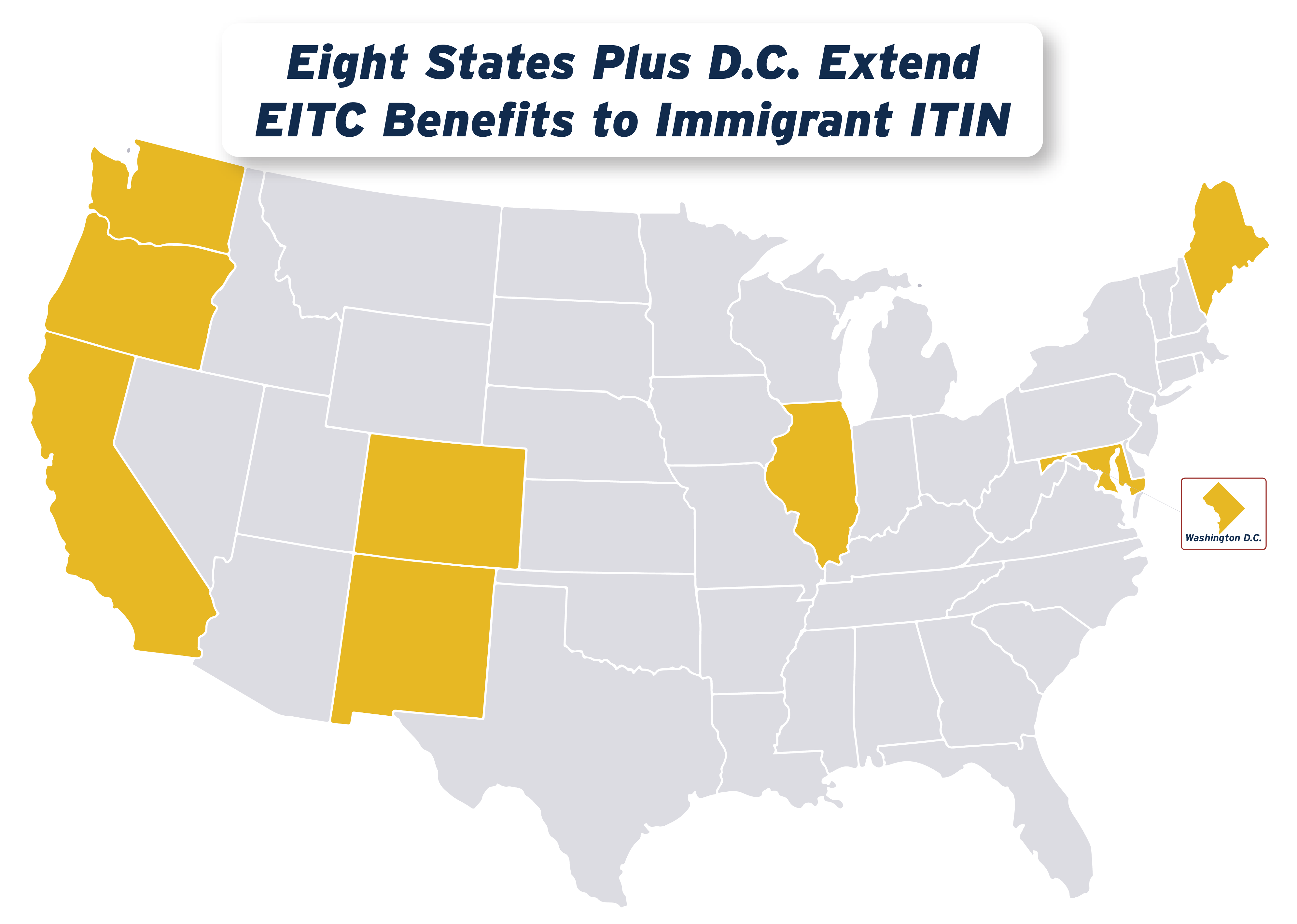

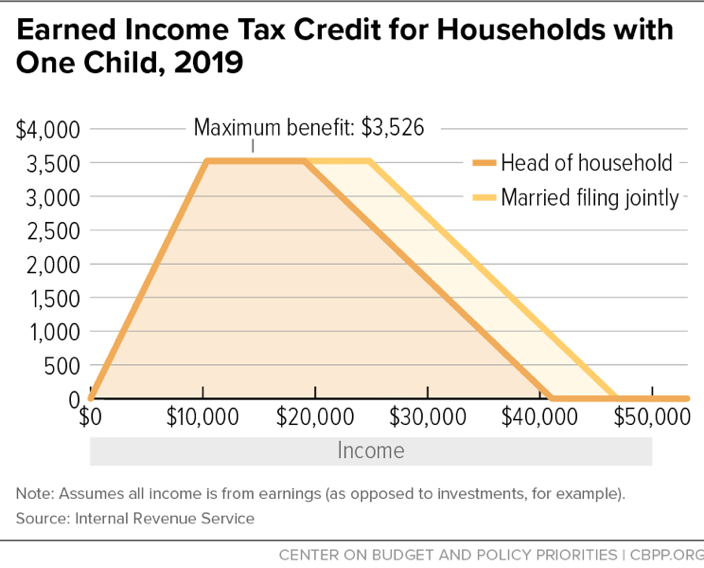

The Earned Income Tax Credit EITC is a refundable tax credit for people who worked in 2021. Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. The state EITC reduces the.

50 of federal EITC 1. The maximum federal credit is 6728. If you are claiming a federal earned income credit EIC enter the earned income you used to calculate your federal EIC.

Eligibility and credit amount depends on your income. State Earned Income Credits Maryland offers a nonrefundable credit which is equal to the lesser of 50 of the federal credit or the State. Required to file a tax return.

HB 679 increases access to the Maryland Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes. See Marylands EITC information page Latest. 2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit.

The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. SB 619 increases the value of Marylands Earned Income Tax Credit for workers who dont have children and non-custodial parents who arent claiming dependents on their taxes by increasing. The credit amount is limited to the lesser of the individuals state tax liability for that year or the maximum allowable credit of 500.

Earned Income Tax Credit EITC Rates. Earned income includes wages salaries tips. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years.

It is a special program for low and moderate-income persons who have been employed in the last tax year. See Worksheet 18A1 to calculate any refundable earned income tax credit. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break.

The program is administered by the Internal Revenue Service IRS and is a major anti. If you qualify you can use the credit to. 28 of federal EITC.

Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return.

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Earned Income Tax Credit Eitc A Primer Tax Foundation

Among New Maryland Laws Effective Monday Help For Parents Paying Thousands Of Dollars For Child Care Baltimore Sun

How Do State And Local Individual Income Taxes Work Tax Policy Center

Who Gets Checks Tax Breaks And When From Maryland S Coronavirus Pandemic Relief Act Package Baltimore Sun

Earned Income Tax Credit Overview

Maryland Refundwhere S My Refund Maryland H R Block

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

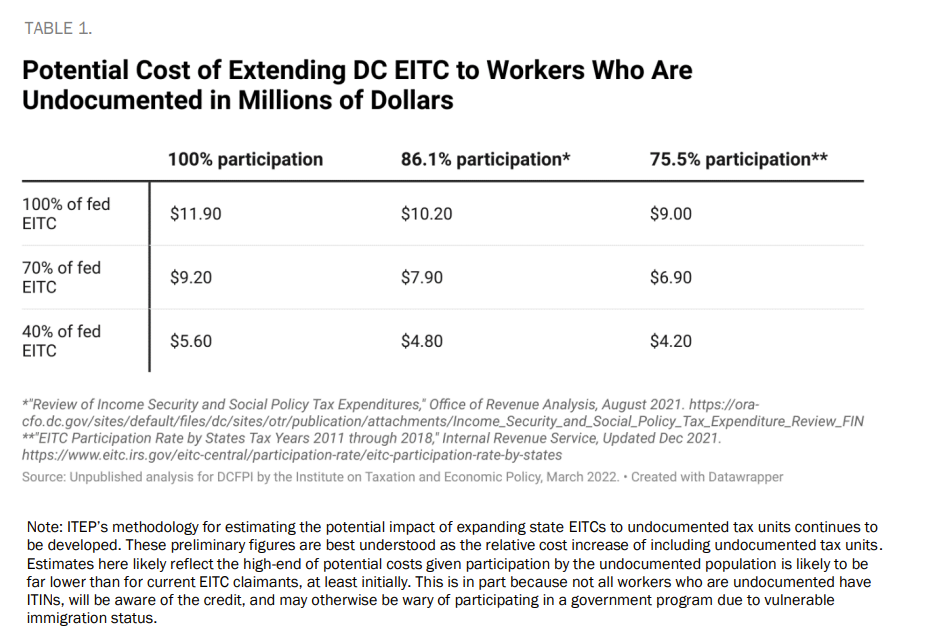

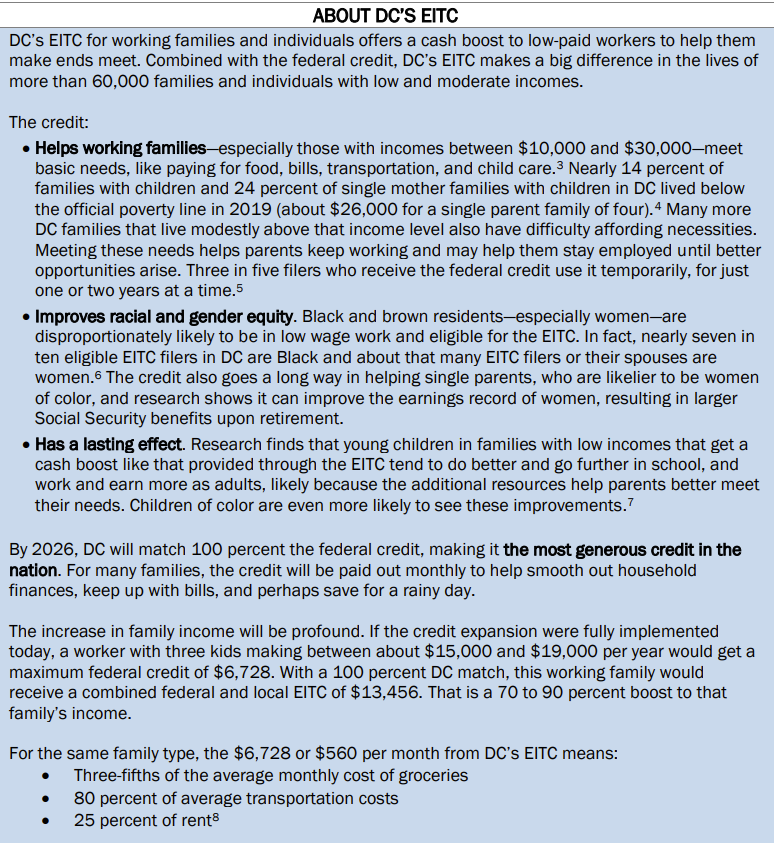

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

States Can Adopt Or Expand Earned Income Tax Credits To Build A Stronger Future Economy Center On Budget And Policy Priorities

What Is The Earned Income Tax Credit Eitc Get It Back

Financial Services In Gaithersburg Md

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

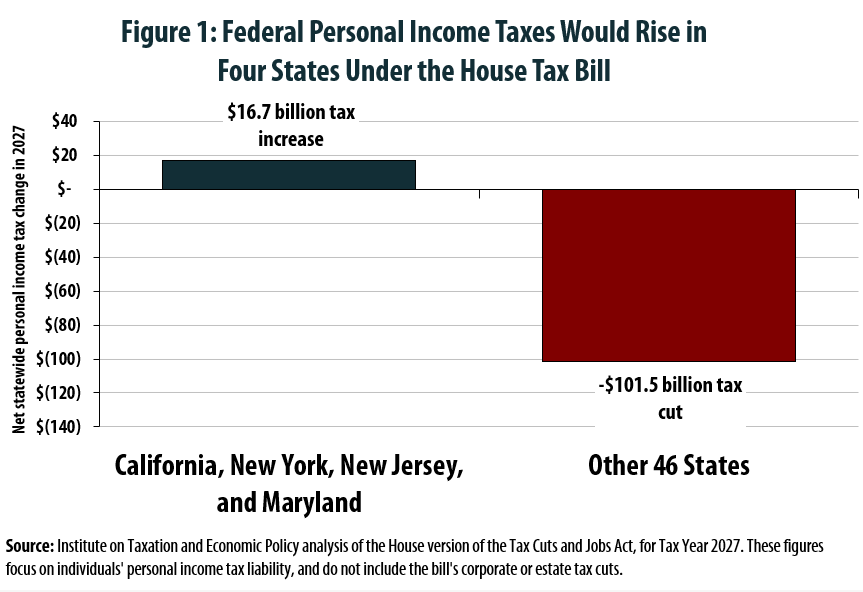

House Tax Plan Offers An Exceptionally Bad Deal For California New York New Jersey And Maryland Itep

State Individual Income Tax Rates And Brackets Tax Foundation